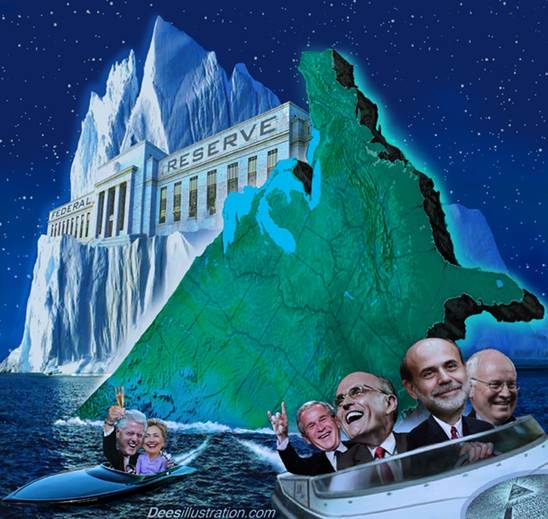

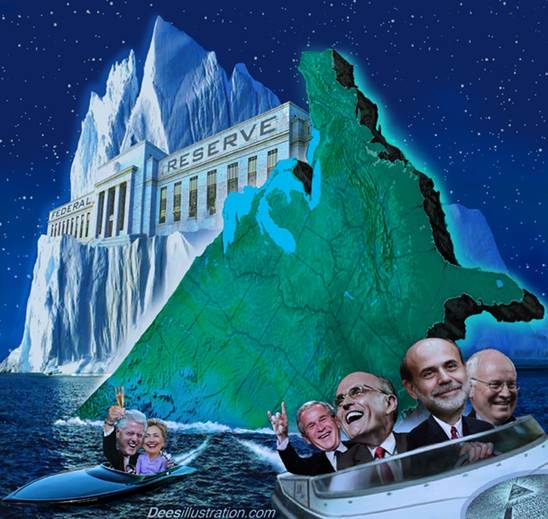

A picture is worth a thousand words. The first article is perhaps the best and it is in clear English.

We were also part of it. Seeing house prices going up year after year was good for morale, until the bubble burst. Selling to the next generation, to our children was hurting them so they stayed at home or rented. They didn't buy because they couldn't. So the game was bound to end sooner or later. Earlier generations found this out the hard way. They were victims of the South Sea Bubble [ England ], the Mississippi Company [ France ] both brought to us by a Scots crook called John Law. Then there was the Tulip Mania [ Holland ]. They inspired that well known book, Extraordinary Popular Delusions and the Madness of Crowds. We found our Ship of Fools. In 1920 Charles Ponzi and his get-rich-quick scam gave people a chance to learn what they had forgotten. Now it is the next time. NB Another, more sympathetic view of Law is at John Law the Scottish gambler who rescued France from bankruptcy.

Of course the sub-prime loans that Clinton forced onto the market meant that loans went to people who couldn't pay them off. That means blacks in particular. You doubt it? See Guess Again Who's To Blame For The US Mortgage Meltdown to know. Forcing bad loans brought matters to a head faster. Robert Rubin had a big hand in that. A huge problem was people in the finance industry making humungous bets on risks that were not thought through. The Long-Term Capital Management affair was an earlier example which was contained because it was a one off at the time.

Fractional Reserve Banking is another problem which causes inflation and destroys the value of our savings. Governments can inflate too by running the printing presses faster. That is what Mugabe is doing in Zimbabwe and Brown is doing to England. They are both robbing people.

One aspect that shows up when we look into it

is that there are a lot of Jews involved. If you say this, accusations of

Anti-Semitism can come your way. Think of

Al

Greenspan [ Jew ], ex-chairman of the Fed, Robert Rubin

[ Jew ],

Treasury secretary,

Ben Bernanke [ Jew ],

the current Fed boss. They jointly set up the housing bubble that is currently [

August 2011 ] causing major pain. Add in the

Rutting chimpanzee Dominique

Strauss-Kahn [ Jew ] who ran the IMF until he was done for rape to see what kind of swine

run the world financial system. A good financial overview is

Capitalist Fools? but it should not be accepted blindly. The writer [ a Jew

] is

part of the game. He is one of the guilty and all about when it comes to blaming

other people.

There is an answer to the situation which the Icelandic government used. It worked well. They did not rob people. They did not print money. They let the banks go broke. The guilty got their comeuppance. The Establishment huffed and puffed - then they all went quiet in case honest people got the idea. See Iceland Sorted Financial Crisis, No One Hurt Apart From Fat Cats.

Here are some sources regarding the players and

the causes. Read for yourself. Think for yourself. Decide for yourself. My views

of the participants are at the bottom.

A picture is worth a thousand words. The first article is perhaps the best and

it is in clear English.

The Quiet Coup - The IMF Explains

Professor Johnson says; Been there, done that. The men who run the system need to be gripped. He does not advocate the gallows; I do. Why? See the next one.

Hidden Clinton Success Story - Fannie Mae Subprime Loans For Minorities

QUOTE

Today's subprime mortgage meltdown began with a lofty, deliberate, fuzzy-headed effort by the Clinton administration to turn more Latinos and blacks into homeowners,............Yesterday's soft and cuddly government program is today's financial chainsaw massacre. Far from an illustration of free-market dysfunction, today's mortgage mess is a classic case of socialistic governmental intervention gone awry.

UNQUOTE

The Main Steam Media have gone quiet about this one but they are propaganda machines. Clinton set it up. Chickens came home to roost later.

Mortgage Meltdown

Men out there saw it coming, or so they say now. A lot of it makes sense.

The Big Takeover of 2009

This says that Big Finance took Big Government for a bunch of suckers. It could well be right. There is certainly much truth in it.

LIBOR

The London Interbank Offered Rate is subject to fraudulent manipulation.

Trends Research Institute

QUOTE

Gerald Celente is on the record for accurately forecasting and naming the current "Great Recession"; for forecasting the 1987 Stock Market Crash, the Dot-com bust, Gold Bull Run to Begin, 2001 Recession, the Real Estate bubble, the "Panic of '08", Tax Revolts, the coming "Greatest Depression" and many more social, economic, business, consumer and geopolitical trends...

UNQUOTE

If you think other prophets of gloom are pessimistic try Gerald Celente talking about food riots, tax strikes, you name it.

The Big Short - Inside the Doomsday Machine

QUOTE

Based on reading Michael Lewis' Liar's Poker and Moneyball, I wondered whether The Big Short would prove to be entertaining and informative. If you've read some of Lewis' books, you might agree that the "entertaining" part would seem to be a reasonably safe bet. It turns out, it is. The Big Short is fast-paced, straightforward, conversational and salty--very much like his earlier works. Indeed, if you didn't know Michael Lewis had written this book, you could probably guess it. It is easy reading and very hard to put down. In short (no pun), The Big Short doesn't disappoint in being entertaining........This is a very interesting, entertaining and informative book that accomplishes what it sets out to do. Chances are you'll enjoy it.

UNQUOTE

Michael Lewis was on the inside. He knows what he talking about and lets us, the little people know.

The Financial Crisis A Libertarian Perspective

A real economist writes - that is not necessarily a good sign but he insists on evidence of what works and what does not.

Banks Survive 5 MPH Bumper Test

QUOTE

With great fanfare it was leaked (at strategic market moments throughout the week) and then announced that the 19 largest banks all passed the so-called "stress tests." Under a test track of their own choosing, and with the ability to negotiate the interpretation of the damage resulting from an ultra low-speed collision, the banks have now been proclaimed "safe at any speed."

UNQUOTE

Do you feel more relaxed when they start lying to you? I don't. Perhaps I am paranoid.

Financial Regulation Explained

QUOTE

Our view of the economy is governed by three fantasies. One is the currently [ 2009 ] unfashionable illusion of eternal boom. Second is the now dominant delusion of doom. Experience tells that these visions, while harmful, express errors that are ultimately self-healing. It is the third of the illusionary prejudices about which we need to worry. It is the illusion of regulation. Those infected by this fantasy assume that the current crisis could have been prevented and can be overcome by devising new regulatory instruments. Do you suspect that the crisis came about because existing regulations have failed? In that case you will be concerned by the effect of the rules about to be imposed upon us. Of the three illusions, the regulatory one is the most dangerous because its exaggerated assumptions become institutionalized. Therefore, the fallacy's harmful consequences can not be overcome by nature asserting itself. Politics will make the correction of the wrong regulations long and tortuous.

UNQUOTE

Good sense is rare, especially when big, big money is involved.

Financial Problems Solved

Germany and Adolf Hitler had the same problems but worse. They were sorted and the system keeps very quiet about how it was done. This is an important clue pointing to the perpetrators. How many bankers are stinking rich? More to the point how many are poor now?

Protecting Yourself From The Next Bernie Madoff

There are some straightforward things to do. Ask the right questions and sleep sound at nights.

South Sea Bubble

Is any of this new? Not a chance. We have been there before. The trouble is that people have forgotten. The comedian that worked this one went on to do it to the French as well. He was another Jock, just like Brown.

Mississippi Company

This was when the French tried to get something for nothing. They came unstuck.

Tulip Mania

It happened to the Dutch too.

Wall Street Under Oath: The Story of Our Modern Money Changers

Was written by Ferdinand Pecora after he did a major inquiry into the Wall Street crash of 1929. The moral is clear: The more things change, the more they stay the same.

People

Capitalist Fools?

Capitalist fools or capitalist rogues? Vanity Fair tells us about the players.

Ronnie Regan Fool Or Rogue?

QUOTE

No. 1: Firing the Chairman

In 1987 the Reagan administration decided to remove Paul Volcker as chairman of the Federal Reserve Board and appoint Alan Greenspan in his place. Volcker had done what central bankers are supposed to do...... Volcker also understood that financial markets need to be regulated. Reagan wanted someone who did not believe any such thing, and he found him..... Greenspan played a double role. The Fed controls the money spigot, and in the early years of this decade, he turned it on full force..... A flood of liquidity combined with the failed levees of regulation proved disastrous.

UNQUOTE

This is fair criticism from Joe Stiglitz as far as it goes which is not far enough to be honest about his own complicity in the 'liar loans' that did so much to cause the collapse. He does not mention that Greenspan was confirmed by the Senate, Bush, Clinton and Bush Mark II.

Warren Buffet - The Sage Of Omaha

QUOTE

Add Warren Buffett to the list of people to blame for the financial crisis: The Oracle of Omaha made a huge profit investing in Moody's, a firm that gave toxic assets the holy triple-A rating. Will anyone escape unscathed by responsibility from the great financial crisis? Not, it would appear, Warren Buffett, the revered Oracle of Omaha. One of the faulty pillars that brought the whole house crashing down was the super-safe, triple-A investment ratings awarded to what we now know were "toxic assets."......... By 2008, while there were still only 12 triple-A-rated corporations in the world, there were more than 64,000 triple-A-rated debt packages with a face value of some $3 trillion, spreading like kudzu through the global banking system.After Moody's Corp. went public in 2000, Warren Buffett's holding company, Berkshire Hathaway, invested just under $500 million, making it by far Moody's largest shareholder. At the time, Moodys was a stodgy bond-rating company that, together with Standard & Poor's and Fitch, enjoyed what amounted to a government-backed monopoly on issuing investment ratings.

The most coveted grade is triple-A, which implies a very low risk of default and allows corporations to sell these bonds to insurance companies, pension funds, and other institutions that are restricted by law to the safest investments. The ratings firms play a double role, both evaluating the risk of a company's debt and for additional fees offering consulting services to help a company raise its score to triple-A.........

Buffett is not only one of the savviest investors in the annals of capitalism; he is also one who prides himself on scrutinizing his major investments. So he must have been aware that Moody's immense profit was based on the proliferation of derivative-backed debt. He is also well-acquainted with credit default swaps which were the window dressing used to justify triple-A ratings because Berkshire Hathaway is one of the major sellers of them.

UNQUOTE

The writer seems to know what he is about. He could well be right.

Greenspan Fool Or Rogue?

QUOTE

President Reagan nominated Dr. Greenspan..... as chairman of the Board of Governors of the Federal Reserve,... After the nomination, bond markets experienced their biggest one-day drop in 5 years. Just two months after his confirmation he was faced with his first crisis, the 1987 stock market crash. His terse statement that the Fed "affirmed today its readiness to serve as a source of liquidity to support the economic and financial system" is seen by many as having been effective in helping to control the damage from that crash. Another famous example of the effect of his closely parsed comments was his "irrational exuberance and unduly escalating stock prices" that led Japanese stocks to fall 3.2%.

UNQUOTE

He kept a lot of people happy for a long time. Now that chickens are coming home to roost fingers are being pointed. The criticisms have a large measure of truth. He let a lot of rogues get away with it.

Madoff Fool Or Rogue?

QUOTE

But on Thursday morning, this consummate trader, Bernard L. Madoff, was arrested at his Manhattan home by federal agents who accused him of running a multibillion-dollar fraud scheme, perhaps the largest in Wall Street's history.........

UNQUOTE

Stealing $50 billion is big time thieving. Gambling the lot away is incompetence as well. You might wonder why he bothered. Most men would settle for a billion without any difficulty.

Paulson Fool Or Rogue?

QUOTE

Notable statements

In Spring 2007, Secretary Paulson told an audience at the Shanghai Futures Exchange that "An open, competitive, and liberalized financial market can effectively allocate scarce resources in a manner that promotes stability and prosperity far better than governmental intervention."

UNQUOTE

He was trying to calm us down or did not really know what was going on. Mr. Gilani in The Global Financial Crisis Explained goes with the latter view. I am not sure. Some problems are just too big. Albeit Hank wanted the absolute authority to spend $700 billion with the slightest accountability or oversight. A man could get even richer that way. He might be a Useful Idiot or just useful.Charles Ponzi Fool Or Rogue?

QUOTE

The sensational rise and fall of Charles Ponzi attracted some attention this side of the Atlantic. The Times christened him the "whirlwind financier", and on July 28, 1920, reported on an amazing "get-rich-quick" scheme [ click on the links for the original Times reports ]:

UNQUOTE

The mug shot is a give away. How long did he get? The Times reported on the man and his times in real time. Greed is a constant. Fear is a variable. Ignorance is dangerous.

Bill Clinton Fool Or Rogue?

QUOTE

Today's subprime mortgage meltdown began with a lofty, deliberate, fuzzy-headed effort by the Clinton administration to turn more Latinos and blacks into homeowners, or so it appears from 1999 news reports buttressed by hard data from a 2007 study of subprime lending. Yesterday's soft and cuddly government program is today's financial chainsaw massacre. Far from an illustration of free-market dysfunction, today's mortgage mess is a classic case of socialistic governmental intervention gone awry.

UNQUOTE

Clinton was brought up in Hot Springs, Arkansas's answer to Sodom and Gomorrah. It didn't get any better. There was the Waco Massacre. Forcing banks to lend to minorities [ code for blacks and Hispanics ] who couldn't pay back was setting up a disaster down the line.

George Bush Fool Or Rogue?

That is easy. Unmitigated evil is the agenda. Whether he wrote it is or was just the front man is another matter but the White House was full of Zionist Jews who certainly made matters worse. The results are dreadful either way.

Ben Bernanke Fool Or Rogue?

It is too early for me to say. Given that he is another Jew I am not optimistic.

John Law

Was the Scot who gave us the South Sea Bubble in England and the Mississippi Company in France while on the run from a murder rap.

Robert Rubin Fool or Rogue?

A Jew who worked for Clinton. This is not a recommendation.

Rutting ChimpDominique Strauss-Kahn

Kahn ran the International Monetary Fund when he wasn't fornicating or raping. A vicious bully, the sort of Jew we do not need anywhere near the levers of power.

Stiglitz Fool Or Rogue?

QUOTE

Joseph Stiglitz is a professor of economics who go a Nobel prize which means that he is intelligent and part of the Establishment. It is does not mean that he is right. He tells us that Al Greenspan is part of the problem but glosses over his own role. Advizing Clinton to make firms lend to people who couldn't pay back, to make 'liar loans' was a certain road to disaster and he knew it. The problem blew up years later, after the 2001 Nobel award and the cheque had cleared. I settle for rogue. He is great at running other people down. He is mouthy. You have to give him that as well as being a Jew. But read for yourself, think for yourself and decide for yourself.

UNQUOTE

He comes across as arrogant and mouthy. See the mug shot; make the decision.

The Times Fingers The 10 Most Guilty

QUOTE

The global financial crisis has evolved into a worldwide recession of epic proportions. Analysts fear the sudden slump which has followed the credit crunch could even rival the Great Depression of the early 1930s and lead to global stagnation. But who is responsible? The bursting of the housing bubble and the collapse in confidence throughout financial markets was not caused by one individual or a single decision, so pointing the finger of blame is a near-impossible task. But Times Money has given it a shot...................1. Dick Fuld

Multi-billionaire and US squash all-star Dick Fuld, 62, was CEO of Lehman Brothers when it went bust in September last year. Dubbed the "scariest man on Wall Street", Dick Fuld is blamed for a litany of mistakes that include leaving Lehman Brothers heavily exposed to toxic US sub-prime mortgage debt and other assets that collapsed in value in the wake of the credit crunch.2. Hank Paulson

If Dick Fuld is responsible for the collapse of Lehman Brothers, Henry Paulson, the former US Treasury Secretary, is the man who let it happen. Anatole Kaletsky, of The Times, says: "The global banking collapse could perhaps be described as a bullet in the head, since its proximate cause was a conscious decision by the US Treasury to jeopardise the stability of the world economy in pursuit of an essentially political objective........... [ Take ANYTHING Kaletsky says with a large grain of salt - Editor ]...... Hank didn't just let Lehmans fail. He made a series of mistakes in the run up to the Lehmans collapse. He also proposed a 700 billion package [ $$s actually ] to boost the US banking system. And how did Hank come up with a figure of 700 billion? "It's not based on any particular data point", a Treasury spokeswoman told Forbes.com, the US financial website. "We just wanted to choose a really large number."3. Alan Greenspan

Alan Greenspan was feted for his management of the US economy while he stood in charge of the US Treasury, but has since been put under the spotlight. He was responsible for cutting interest rates to near zero in the US in the aftermath of September 11, flooding the world with cheap and easily available money...........4. John Tiner/Hector Sants

John Tiner was in charge of the Financial Services Authority, the watchdog that polices the UK's complex financial services industry until 2007, when it was taken over by Hector Sants. The FSA failed to keep a close eye on Northern Rock, the Newcastle-based ex-mutual which gorged on wholesale mortgage securitisation and came a cropper as a result. A key parliamentary committee has said that the FSA was guilty of a "systematic failure".5. Fred "the shred" Goodwin

The "world's worst banker" has brought the Royal Bank of Scotland (RBS), Britain's second biggest bank, to its knees. Last week it announced humiliating losses of �28 billion, the biggest in British corporate history, and economists and analysts have concluded that it could soon be fully-nationalised. In mid-January, taxpayers saw their stake in the banking giant increase from 58 per cent to 70 per cent.6. Gordon Brown

Apparently Gordon Brown predicted the global financial crisis ten years ago, in a speech he made to Harvard students. Sadly he did little to prevent it. James Gordon Brown was Chancellor of the Exchequer during the longest period of growth in the UK's history, but economists blame Mr. Brown for encouraging soaring house price inflation and the spread of credit which fuelled the years of boom and led eventually to the current bust.7. George Bush

The former President was in charge during the boom years when the seeds of the sub-prime implosion were sown, but has failed to take any responsibility for the financial disaster which occurred on his watch. In a speech last year he blamed the bankers in New York for the problems facing his country's economy.8. Kathleen Corbet

The credit rating agencies have been blamed for failing to ask tough questions about the collateralised debt products containing so many toxic sub-prime mortgages, which investors traded for millions of dollars during the booming housing years.....9. "Hank" Greenberg

Another Hank. This one was head of AIG, the insurance giant that had to be rescued in an $47 billion US government bailout just days after Lehman Brothers was allowed to go bust. Hank was in charge between 1967 until 2005, during which time the insurer got heavily involved in the murky world of credit default swaps.10. Angelo Mozilo

Mr. Mozilo was head of the largest sub-prime mortgage lender in the US, Countrywide, until July 2008. Sub-prime lenders in the US have been accused of using misleading marketing to push unsuitable mortgages on sub-prime homeowners who could not afford to service the debt,........ Mozilo reportedly earned $470 million [ make that paid himself - Editor ] in salary and other income.

UNQUOTE

Bush is a fool and a rogue who was used by cunning rogues. Brown is a gross spendthrift and still very dangerous. Add in one innocent. Eliot Spitzer tried to stop thieving on Wall Street and got screwed big time. Here is a picture of the whore he paid for with his very own money unlike various crooks.

Causes and Effects

The Collapse of Iceland's Economy

QUOTE

Iceland's de facto bankruptcy, its currency (the krona) is kaput, its debt is 850 percent of G.D.P., its people are hoarding food and cash and blowing up their new Range Rovers for the insurance resulted from a stunning collective madness. What led a tiny fishing nation, population 300,000, to decide, around 2003, to re-invent itself as a global financial power? In Reykjavik, where men are men, and the women seem to have completely given up on them, the author follows the peculiarly Icelandic logic behind the meltdown.Just after October 6, 2008, when Iceland effectively went bust, I spoke to a man at the International Monetary Fund who had been flown in to Reykjavik to determine if money might responsibly be lent to such a spectacularly bankrupt nation.............. "You have to understand, he told me, Iceland is no longer a country. It is a hedge fund."

UNQUOTE

Michael Lewis writes well and in plain English.

PS Everyone in Iceland knows Bjork and her mother for that matter.

Financial Crisis 2008 Developing

Leads to a series of article in Vanity Fair written as the situation was coming into focus.

Extraordinary Popular Delusions and the Madness of Crowds by Charles MacKay

QUOTE

Amazon.com

Why do otherwise intelligent individuals form seething masses of idiocy when they engage in collective action? Why do financially sensible people jump lemming-like into hare-brained speculative frenzies--only to jump broker-like out of windows when their fantasies dissolve? We may think that the Great Crash of 1929, junk bonds of the '80s, and over-valued high-tech stocks of the '90s are peculiarly 20th century aberrations, but Mackay's classic--first published in 1841--shows that the madness and confusion of crowds knows no limits, and has no temporal bounds. These are extraordinarily illuminating, and, unfortunately, entertaining tales of chicanery, greed and naiveté. Essential reading for any student of human nature or the transmission of ideas....

UNQUOTE

Mob psychology matters to manipulators, the sort that run the main stream media for example.

Fractional Reserve Banking

It sounds quite innocuous. It is not. The idea is that a bank can take in honest money from people and lend out far more. If the bank is holding $1 billion and paying 3% while lending $10 billion at 6% it is getting rich fast. It is also guilty of de facto forgery. It therefore requires government complicity. Producing money by sleight of hand causes inflation which defrauds honest men by reducing the value of their hard earned pay. There is no way for us to tell the difference between funny money and the real thing. That is why banks will not lend to each other - they know that these bits of paper can turn out to be worthless or worse.

Quantitative Easing

QUOTE

The term quantitative easing describes an extreme form of monetary policy used to stimulate an economy where interest rates are either at, or close to, zero. Normally, a central bank stimulates the economy indirectly by lowering interest rates but when it cannot lower them any further it can attempt to seed the financial system with new money through quantitative easing.

UNQUOTE

QE is bad news. It is also much the same as forgery; the difference being that it is Brown robbing us.

Sub-Prime Lending

The Wiki tells us something.

Sub-Prime Lending And Clinton

QUOTE

Today's subprime mortgage market was the result of innovative yet high stakes political decisions by President Bill Clinton and Housing and Urban Development Secretary Henry Cisneros to push homeownership to record levels. Homeownership gains were to be made through emerging market penetration of black, Latino, and Asian immigrant/first-time home buyers and through HUD's instruction of the Government Sponsored Enterprises ofFannie Mae andFreddie Mac to employ strategies to fund more loans by providing more credit primarily to credit-blemished borrowers.

UNQUOTE

Lend money to people who can't repay then look surprised when they do not. But Clinton was out of office by that time and the Boston Globe is covering up for him. It was the same with the Lewinsky thing. The truth comes down the line.

Other Views

The Financial Crisis Explained And Solved

Mr. Gilani is in the business and knows of what he writes. Hanging the guilty sounds like a good idea to me.

The Financial Crisis Explained

WakeUpFromYourSlumber.com has robust views on the evil done by Jews. There are lots of them in the finance industry. This does not prove that it is their fault, not quite but little Mr. Madoff has some explaining to do to his rabbi about the $50 billion that went adrift.

The Global Financial Crisis Explained

By someone seriously in the business. He fingers the comedians who ran AIG among others

In Japan's Stagnant Decade, Cautionary Tales for America

The Japanese passed this way and it hurt. Getting a grip of dodgy banks is part of their answer. They know the Americans are fouling up.

Solutions:-

Sorting The Perpetrators Of Our Financial Crisis [ 8 March 2009 ]

QUOTE

From prison, Bill Lerach, America's premier class-action lawyer, has a roadmap to get all that bonus money back from the Wall Streeters who got us into this mess................. In fact, there is a way for the federal government to go after the obscenely excessive bonuses paid to the Wall Street pigs............... The mere bringing of the suits especially against the directors would have a beneficial deterrent effect on all directors going forward......... Bill Maher had it right when he said, "There are a million lawyers in the United States. Doesn't one of them know how to put a banker in jail?"

UNQUOTE

It can be done. It won't be done. Too many crooks are making big time. They are all scratching each others backs. Rocking the boat would endanger them all.

The Big Takeover of 2009 [ 21 March 2009 ]

Big people matter. Little people don't so they get screwed by the big people. Simple isn't it?

My Verdicts

Ronnie Regan Fool Or Rogue - unlucky rather than foolish. A president has top flight advisors who should have known.

Greenspan Fool Or Rogue - Jew and rogue.

John Law - Scot and rogue.

Madoff Fool Or Rogue - Jew, thief and rogue.

Paulson Fool Or Rogue - Fool and fall guy. Not innocent though.

Robert Rubin Fool or Rogue - Jew and rogue - too intelligent to be innocent.

Charles Ponzi - Italian rogue.

Stiglitz Fool Or Rogue - Jew and rogue.

Bill Clinton Fool Or Rogue - rogue who colluded with Jews.

George Bush Fool Or Rogue - fool and rogue, used by Jews

Errors & omissions, broken links,

cock ups, over-emphasis, malice [ real or imaginary ] or whatever; if

you find any I am open to comment.

![]()

Email

me at Mike Emery. All

financial contributions are cheerfully accepted. If you want to keep

it private, use my PGP Key. Home

Page

Updated on 19/11/2020 09:10